The Swiss indirect real estate universe is characterised by a continually growing number of listed and unlisted fund providers and companies as well as investment foundations. Many providers are distinguished by streamlined corporate structures in order to succeed in this competitive market. The focal point of reporting is directed at returns-oriented key financial figures, with which sophisticated institutional investors are becoming less satisfied over time. This trend leads to a change in mindset that not every provider is able to equally and swiftly manage amid this strongly fragmented investment universe. We therefore seek dialogue in the sense of “engagement” especially with those providers that have not yet published any ESG report. At the same time, we can provide impulse for more transparency and motivate providers to integrate ESG criteria into their investment process. We are convinced that our approach leads to higher earnings momentum as well as a more favourable ecological balance.

Only those companies that know their consumption numbers are able to optimise them as well. Whether the improvement is economically or ecologically driven is irrelevant at present. The resulting advantages for investors are twofold: on the one hand, lower costs; on the other, reduced consumption of natural resources and, in turn, a better reputation for the investments.

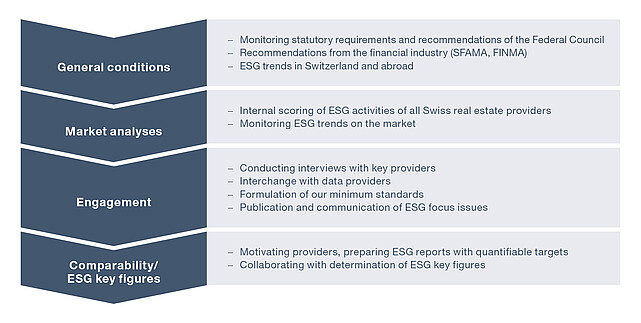

We have spent considerable time on the issue of whether particular providers should be assigned individual ESG ratings. In this regard, we scrutinised which key figures would be relevant and whether each provider could be subjected to their standardised calculation. That may be interesting for institutional investors. However, when we further contemplate the concepts of biodiversity and inclusion, we come to the conclusion that a clearly defined selection of key figures limits the provider, which could lead to false moves on the market. Of course, we advocate in-depth analysis of ESG criteria and definition of quantifiable targets. In our opinion, providers are responsible for setting ESG targets and regularly reporting progress of their ESG strategy. Individual ESG targets hamper – or even make impossible – comparability of particular providers. These are subject to legal requirements, which to a large extent meet the high standards of sustainablity at present. Our process involved analysing every provider with regard to publicly accessible ESG-relevant information. We subsequently opened the door to dialogue with numerous providers in winter 2019/20. We are fine-tuning this process and delving deeper into various aspects in a second round of questioning. At the same time, the focus here will be directed at formulating targets and time horizon. In the medium term, we aim to rule out providers from our investment universe that do not seriously address ESG criteria. With our investment approach, we are engaged in an interchange of ideas with ESG specialists and strive to apply new insights – which are frequently based on international analyses – to our investment segment. We therefore maintain constant dialogue with a vast array of stakeholders and, in turn, set quantifiable incentives.

ESG approach to Swiss indirect real estate

A regularly recurring process

Investment approach for Swiss indirect real estate

Swiss Finance & Property Funds AG’s team for indirect real estate Switzerland has been dealing with the issue of how to compile, assess and integrate environmental, social and governance (ESG) criteria into the investment process already for some time.