The systematic exclusion of specific issuers due to activities or business practices that violate given norms or values or due to anticipated risks.

SF Property Securities Fund

The SF Property Securities Fund invests in listed shares of Swiss real estate companies and listed Swiss real estate funds. The fund is broadly diversified across the Swiss real estate market by regions, types of use and investment styles of the underlying real estate investments.

Stock selection is focused on investments that display a stable rental income and positive performance. Thus, the fund targets a high income yield and the preservation of capital value.

Factsheet

SF Property Securities Fundas at 31 December 2025

| Share Class I - NAV CHF 267.05 |

Description

The fund invests in listed real estate funds and companies, as well as in non-listed real estate funds.

In addition to real estate funds, the product invests in real estate companies that enable additional earnings potential through other value-creation strategies. Investments in unlisted real estate funds stabilize long-term performance and facilitate optimization of the risk profile based on the market phase.

Fund Data

| Name | SF Property Securities Fund |

| Asset Manager | Swiss Finance & Property AG |

| Auditors | PricewaterhouseCoopers AG |

| Depositary bank | UBS Switzerland AG |

| Reference currency | CHF |

| Benchmark | 50% SXI Real Estate Funds Broad 50% SXI Real Estate Shares Broad |

| Launch of share class | 03.11.2008 |

| Launch of fund | 01.11.2006 |

| ISIN / Valor numbr | CH0045826101 / 4582610 |

| Distribution | Annually in March |

| Liquidity | Daily |

| First-time minimum payment | CHF 5 mn |

| Subscription and Redemption Fee | 0.15% on behalf of the fund |

| Management Fee 1 | 0.50% p.a. |

| Total Expense Ratio (TER) 2 | 0.55% |

| Total Assets | CHF 1057.8 mn |

1 Investments in SFP products are not included in the management fee calculation.

2 As at 31.12.2024, TER (fund of fund) denotes the sum of all costs and commissions charged to the fund assets on the fund of f

Information on other share classes can be found in the factsheets below.

Share Class I - Performance: Base 100 (Net)

| in % | YTD | 1 mt | 3 mts | 1 year | 3 years | 5 Y |

| Fonds | 16.72 | 1.89 | 6.28 | 16.72 | 47.08 | 39.57 |

| Benchmark | 17.06 | 1.90 | 6.45 | 17.06 | 46.71 | 36.82 |

Share Class I - Statistical Analysis

| 36 months rolling | Funds | Benchmark |

| Performance p.a. | 13.72% | 13.63% |

| Volatility | 5.69% | 5.64% |

| Sharpe Ratio p.a. | 2.41 | 2.42 |

| Tracking Error p.a. | 1.04% | - |

| Information Ratio | 0.09 | - |

| Risk-free rate | -0.02% | - |

Investment Type

Sectors

Regions

Sustainability

The fund supports the achievement of the Swiss Federal Council's 2050 climate targets and pursues the listed sustainability approaches. The investment objective and the sustainability policy of the SF Property Securities Fund are defined in the prospectus with integrated fund contract. Further explanations on sustainability can be found at www.sfp.ch/en/products/sf-property-securities-fund. The fund qualifies itself as Article 8 SFDR in the pre-contractual information.

Environmentally Relevant Key Figures

| Measured variable | Unit | Fund |

| Energy intensity in operation | KWh/m2/year | 105.0 |

| Share of renewable energy | % renewable of energy consumption | 44.0 |

| GHG intensity in operation | kgCO2/m2/année | 10.7 |

The key figures are based on publicly available information from third-party providers on the reporting date. Not all third-party providers publish information, which is why the degree of coverage is not necessarily 100%. The calculation methods are harmonised. This leads to retrospective corrections, which we apply in each case.

GRESB Rating1

| GRESB Standing Investment | 4 von 5 | ||

| GRESB Score Standing Investment | 89 von 100 | ||

| GRESB Average (Global participants) 2 | 81 von 100 | ||

| GRESB Peer Average (Swiss participants) 2 | 87 von 100 |

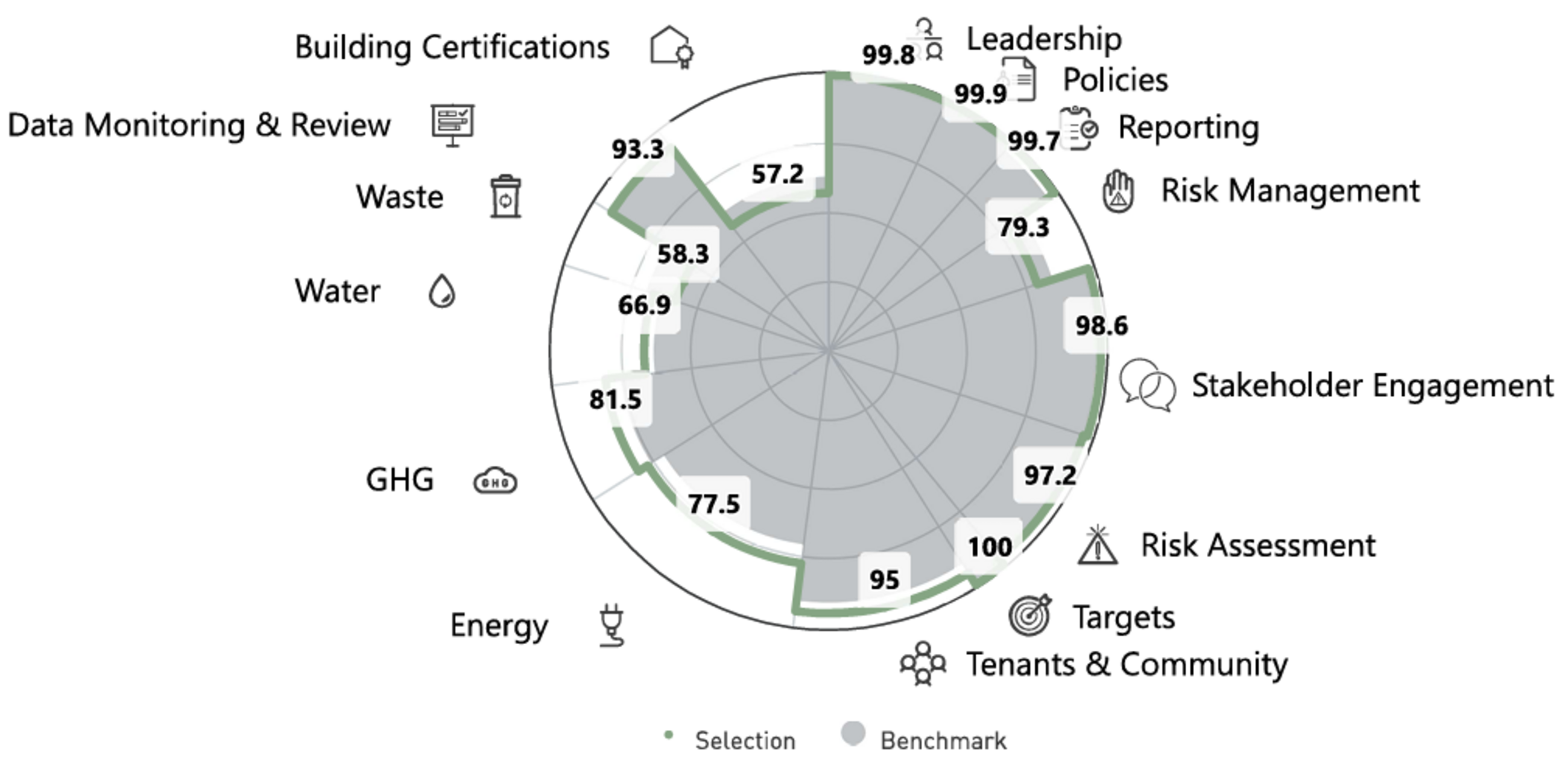

GRESB Portfolio Summary2

Source: GRESB

All intellectual property rights to this data belong exclusively to GRESB B.V. All rights reserved. GRESB B.V. has no liability to any person (including a natural person, corporate or unincorporated body) for any losses, damages, costs, expenses or other liabilities suffered as a result of any use of or reliance on any of the information which may be attributed to it.

GRESB ESG Breakdown1

Source: GRESB

Sustainability Approaches

The degree of coverage measured in terms of assets under management is approx. 83.3%.

1 The GRESB ESG Breakdown and the GRESB Rating are based on the GRESB reports for the calendar year 2024 and are calculated using the current portfolio allocation.

2 The GRESB Portfolio Summary, the GRESB Average and the GRESB Peer Average are based on the allocation as at 31.10.2025 and the GRESB reports for the calendar year 2024.

The information in the factsheet linked below is relevant.

Sustainability

SF Property Securities Fund pursues a sustainability policy that is based on the consistent evaluation of the ESG performance indicators that are relevant to the selection of investments. A regular ESG dialogue with all relevant market players provides sustained support to developments ensuring the availability of transparent and comparable information.

The investment objective and sustainability policy of SF Property Securities Fund are defined in the prospectus with integrated fund contract.

The sustainability strategy of SF Property Securities Fund aims to ensure the greatest possible coverage by GRESB data (Global Real Estate Sustainability Benchmark) and the systematic capture of environmental indicators for all investment vehicles. The focus falls mainly on the long-term reduction of greenhouse gas emissions. Voting rights are exercised, with a particular emphasis given to appointing competent persons to the boards of directors of all companies.

Sustainability Approaches

Consideration of sustainability risks and opportunities in traditional financial analysis and investment decision-making on the basis of systematic processes and appropriate research sources.

This is often used to refer to a combination of engagement and voting:

Voting: Expressing preferences with regard to sustainability issues by actively exercising voting rights.

Engagement: Active dialogue with the aim of convincing to consider environmental, social, and governance criteria within their sphere of influence.

Reduction of the environmental footprint by lowering greenhouse gas emissions over time. A long-term goal should be implemented.

SFDR

This fund qualifies itself as Article 8 SFDR in the pre-contractual information. Further information can be found in the documents below.

SFDR documents for the SFP Group can be found here.

Contact

Senior Portfolio Manager Indirect Investments

Senior Portfolio Manager Indirect Investments

Senior Portfolio Manager Indirect Investments

Senior Portfolio Manager Indirect Investments

Head Client Relationship Management & Marketing