The Corporate Finance & Capital Markets team of Swiss Finance & Property Ltd has reached another milestone. In spring 2023, Swiss Finance & Property Ltd for the first time acted as sole lead manager for a capital increase of Orascom Development Holding AG. Thanks to meticulous planning and optimal timing, the only issue of equities by a Swiss listed real estate company so far this year could be executed successfully in spite of the challenging market environment.

Impact of rising interest rates on financing, valuations and share prices

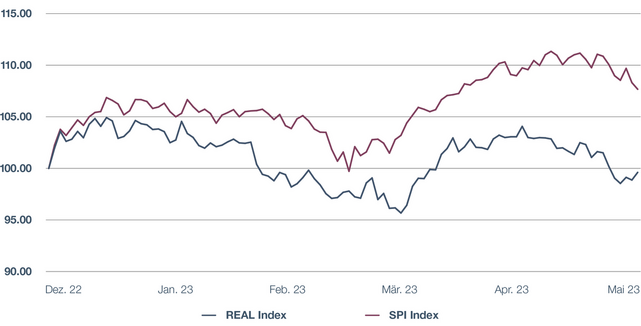

The Swiss capital market has seen significant changes in the past months. The changed interest situation poses a new challenge for Swiss real estate companies. Because of current market conditions, planned financing transactions require a clearly defined strategy. Maturing bonds and loans can only be renewed at higher conditions. In September 2022, the Swiss National Bank put an end to the low-interest phase that has been ongoing since 2014 by increasing the policy rate by 75 basis points. Until this time, Swiss real estate companies could borrow capital easily and quite cheaply. Big real estate companies issued long-term bonds for billions with coupons of just over 0 per cent. Today, new bonds are issued with coupons of 1.54% (three-month bond) to 3.13% (six-year bond). It is noticeable that new bonds issued during the past two years have considerably shorter maturities than older bonds. The rise in interest rates not only leads to higher financing costs, but can also result in property devaluations. When looking at the price performance of listed real estate shares, it is clear that investors are proceeding with the utmost caution: the performance for the REAL Index (index for listed real estate shares in Switzerland) was -0.4% (total return) for the first five months of the year. Over the same period, the Swiss Performance Index (SPI) gained 7.7%.

REAL Index – SPI Index

Focus on refinancing

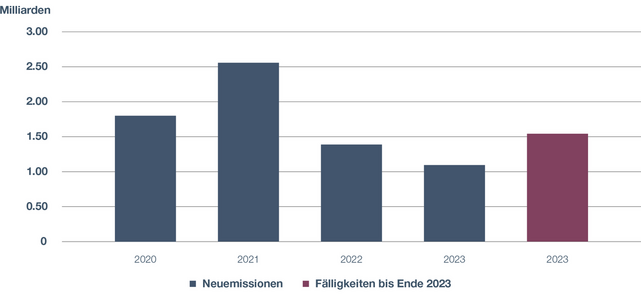

In the past few months, listed companies such as PSP, HIAG, Allreal, Mobimo and Peach Property have issued substantial volumes of bonds. In total, these real estate companies floated bonds for more than CHF 1.1 billion, which is almost on a par with the entire prior year (CHF 1.4 billion). Given the upcoming maturities, another round of refinancing will take place before the end of the year.

Bonds of more than CHF 1.5 billion will mature, a huge chunk of which date from the low-interest phase. In the current market situation, new bonds can only be issued under higher conditions. Companies should therefore carefully review their financing options.

Bonds of Swiss real estate companies

Difficult market environment calls for preparation

With the end of the low-interest phase, the volume of capital market transactions by Swiss real estate companies has contracted substantially. In spring 2022, companies such as EPIC Suisse AG (with Swiss Finance & Property Ltd as co-manager), Ina Invest AG and Mobimo Holding AG still successfully placed new equities for a total of CHF 374 million on the market. In the first half of 2023, only the international project developer Orascom Development Holding AG managed to do this. Swiss Finance & Property Ltd for the first time supported this transaction as sole lead manager, together with Helvetische Bank as settlement agent. The small number of issues once again shows how challenging the primary market has become. Only NAV-based investment vehicles with an investor base of tax-exempt pension institutions continue to enjoy a healthy demand. At the end of May 2023, the planned emission volume for this asset class was more than CHF 1.3 billion. In contrast, the volume of emissions announced by real estate funds and stock companies was only CHF 527 million.

Outlook for the second half of 2023

In addition to the listed stock companies' need for refinancing, several listings of Swiss real estate funds are scheduled for the second half of the year. The IPO of Credit Suisse 1A Immo PK, which was postponed last year, is still pending, as is the IPO of ZIF Immobilien Direkt Schweiz. With a market capitalisation of CHF 3.3 billion (CS) and CHF 1.1 billion (ZIF), these funds are anything but lightweights. These two potential listings on the SIX Swiss Exchange alone will considerably restrict the leeway for their own emissions of other real estate funds. Because of their substantial size, their inclusion in the index will also result in major portfolio adjustments by index investors. As a result, the inclusion of new funds in the index will bring greater selling pressure to bear on the units of existing index members. Apart from the right timing, many other conditions have to be met for a successful issue. To gain the crucial support of existing investors, it is expected, among other things, that the new money creates quality and added value for the portfolio. Dilutions are not welcomed. The pricing of the transaction must also be attractive, and in contrast to equities, the fund units must have a healthy premium.

Conclusion

The difficult market environment and changing framework conditions are posing challenges for the capital market transactions of Swiss real estate companies. Meticulous preparation, cooperation with an experienced capital market specialist such as Swiss Finance & Property Ltd and a clearly defined value-added strategy are key to the success of such transactions. Companies have to respond to the increased requirements of the market and implement the necessary measures. The expertise and support of established capital market experts could be extremely valuable here. As a competent partner and one-stop shop, Swiss Finance & Property Ltd is ready to support companies in planning and implementing capital market transactions and to offer long-term strategy advice and market-making services. Companies can improve their chances for successful transactions by adopting a proactive approach.