SFP AST Global Core Property Unhedged

SFP AST Global Core Property Unhedged offers Swiss pension funds access to a global portfolio of open-ended, non-listed core real estate funds. Its focus lies on strong cash flow, strategic diversification enabled through active portfolio management, and sustainability.

The investment group focuses on real estate funds that invest directly in high-quality properties in prime locations with strong leasing profiles. The core approach is further reinforced by a conservative debt profile. Active portfolio management is employed to achieve strategic diversification across sectors and regions based on market trends and fundamentals.

Sustainability

ESG analysis represents an integral part of the investment process. In 2023, SFP AST Global Core Property* was awarded 88 GRESB points and a five-star rating. The investment group significantly exceeded the GRESB and peer average of 75 points each. As part of our ESG-Engagement strategy, relevant ESG criteria and targets are consistently evaluated through regular dialogue with fund managers. We remain committed to our goal of continuously improving our ESG approach. Our efforts are supported by the transparent data reporting by underlying funds for the annual GRESB assessment.

* for the hedged CHF portfolio

Factsheet

SFP AST Global Core Property (Unhedged)as at 31 December 2023

| Class A - 780.15 / Class B - CHF 804.47 / Class X - CHF 817.82 |

Description

SFP AST Global Core Property offers Swiss pension funds access to a global portfolio of open-ended, non-listed core property real estate funds. Its focus lies on strong cash flow, strategic diversification enabled through active portfolio management, and sustainability.

Key Facts

| Legal form | Swiss Investment Foundation – the investment group falls under the category 'foreign real estate' (article 53, paragraph 1, letter c, BVV 2) |

| Investment manager | Swiss Finance & Property Ltd |

| Depositary bank | Credit Suisse (Schweiz) AG |

| Investment strategy | Core |

| Fund structure | Open-ended |

| Liquidity | Quarterly |

| Regional exposures | Global (excl. Switzerland) |

| Sector exposures | Residential, industrial/logistics, office, retail, other |

| Launch date | September 2017 |

| Currency | CHF |

| Foreign currency hedging | Investors have the option to invest in a hedged or an unhedged investment group |

| Leverage | No leverage at the investment group level |

| TER KGAST (2022) | 1.08% - 1.79% |

| Next subscription/redemption | Closing: 31 March 2024 (value date) Capital commitment/redemption: 11 March 2024 |

| Subscription/redemption thereafter | Closing: 30 June 2024 (value date) Capital commitment/redemption: 10 June 2024 |

| Notice period | 12 months |

Portfolio Key Figures

| Total assets of the investment groups | 178.1 |

| Number of funds (committed) | 15 |

| Number of funds (invested) | 14 |

| Number of underlying properties | 1702 |

| Gross asset value of underlying properties (in CHF bn) | 91.8 |

| Occupancy rate (in %) | 93.5 |

| WAULT (in years) | 5.2 |

| Leverage (% of GAV) | 23.8 |

Performance

(neto total return)

| YTD | 3 M | 1 yr | 3 yr (p.a.) | 5 yr (p.a.) | Since launch (p.a.) | |

| Class A | -18.79% | -8.96% | -18.79% | -3.93% | -3.23% | -2.94% |

| Class B | -18.61% | -8.91% | -18.61% | -3.72% | -3.02% | -1.98% |

| Class X | -18.26% | -8.81% | -18.26% | -3.31% | -2.60% | -1.58% |

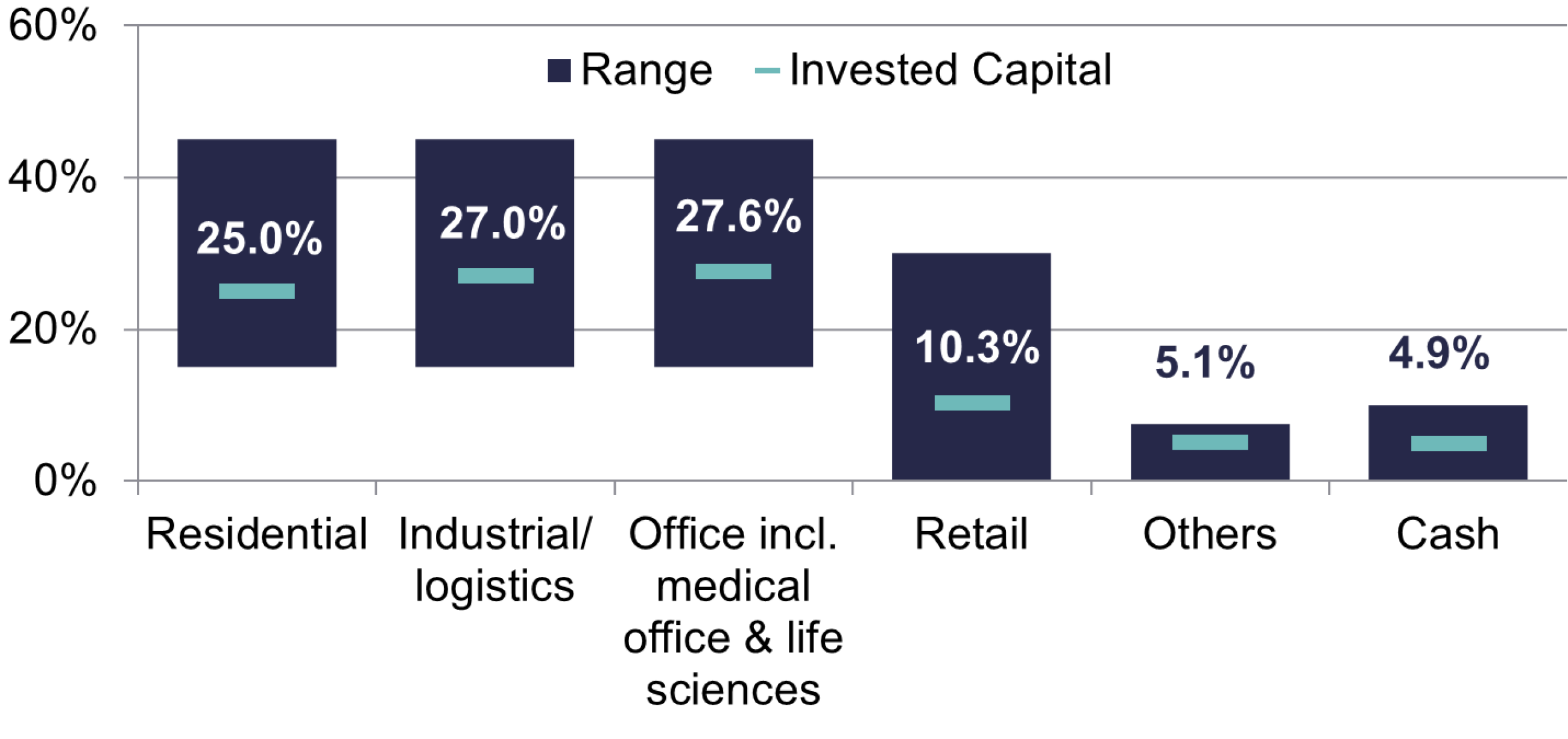

Sector Exposures

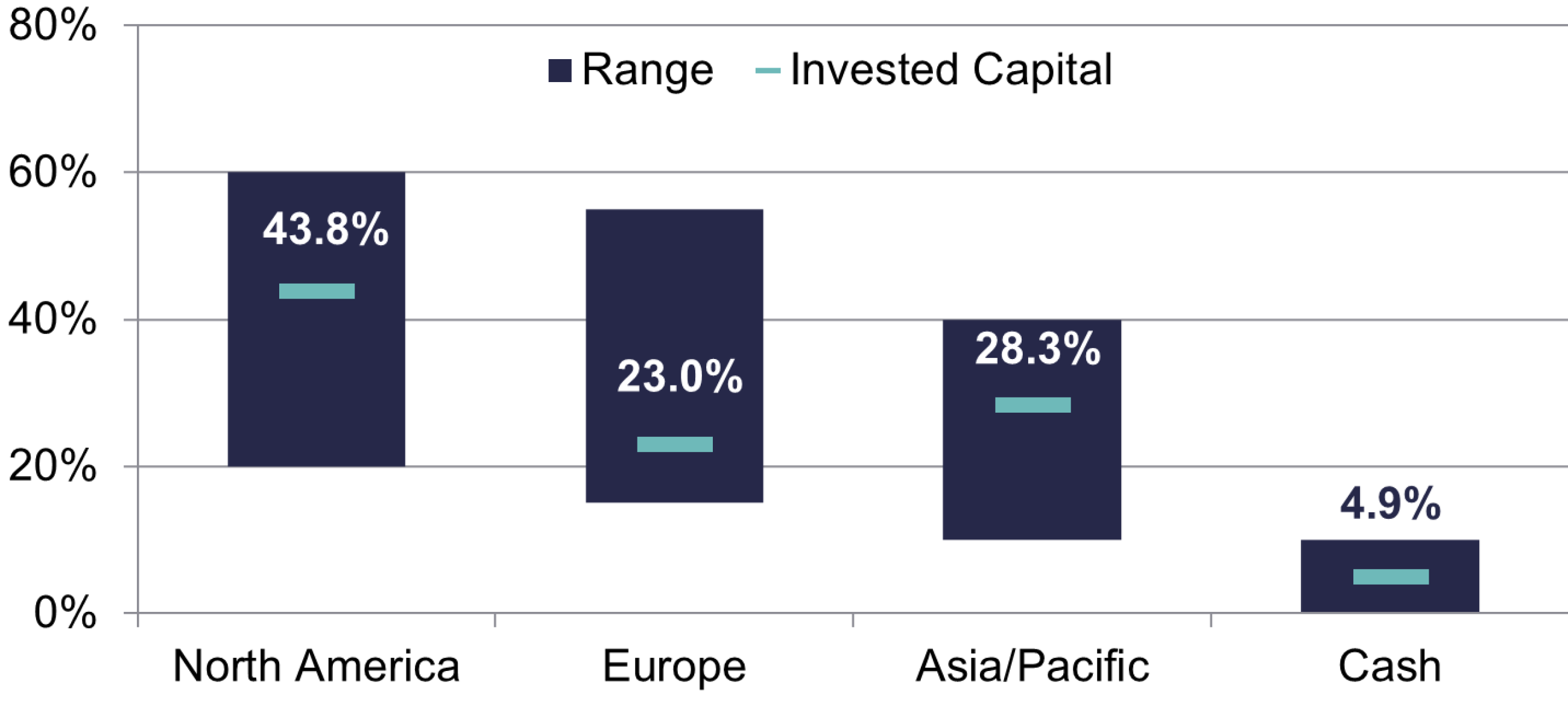

Regional Exposures

Currencies

The information in the factsheet linked below is relevant.

Contact

Senior Portfolio Manager

SFP AST Global Core Property

Head Client Relationship Management & Marketing