Infrastructure secondaries have emerged as a resilient and strategic investment avenue, offering investors immediate exposure to de-risked, cash-generating assets while providing enhanced portfolio flexibility, attractive pricing opportunities, and a favourable risk-return profile in an increasingly dynamic market environment.

The infrastructure market has grown significantly over the past decades, driven by fiscal pressure, rising public debt, and an increasing reliance on private capital to bridge investment gaps. Technological advances, especially in digitalization and AI, have fuelled growth, particularly in the communications sector, while the global shift toward sustainability has boosted investment in energy transition assets. Together, these trends highlight the evolving landscape and long-term investment potential across sectors.

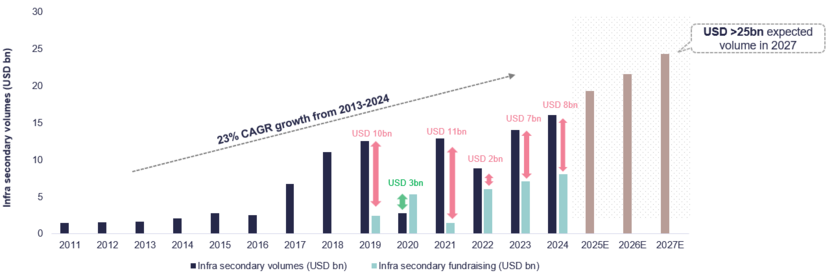

This expansion has also fuelled the infrastructure secondary market, which grew at a compound annual growth rate (CAGR) of 23% between 2013 and 2024, and is projected to surpass USD 25 billion by 20271. Infrastructure transaction volume in the secondary market has roughly doubled since 20171, reflecting the growing maturity and institutionalization of the asset class. Notably, this growth has accelerated over the past two to three years, largely due to the so-called denominator effect, which pressured investors to actively manage portfolio allocations amid market volatility. As a result, both LP-led and GP-led secondary transactions have gained momentum, offering investors a liquidity option to the dry exit market.

Far more than a liquidity solution, secondaries serve as a strategic entry point into mature, well performing assets, often available at attractive valuations due to the liquidity need. Their ability to offer immediate exposure, reduce blind-pool risk, and provide earlier yield makes them particularly appealing in uncertain macroeconomic environments. As a result, infrastructure secondaries have become a central component of the investment landscape, supporting capital recycling and expanding market access.

Looking ahead, the market is well-positioned for continued growth. Structural tailwinds, including the asset class’s ongoing maturation, LPs’ emphasis on active portfolio management, and the broader acceptance of secondaries as a core allocation strategy, are set to drive further expansion.

At the same time, capital availability hasn’t kept pace with transaction volume, creating a favourable environment for buyers. This imbalance is translating into more attractive pricing, improved governance rights, and greater negotiating power. Only the most compelling opportunities, are being executed, raising the bar for quality and giving well-capitalized investors a distinct advantage.

Secondaries as a strategic investment

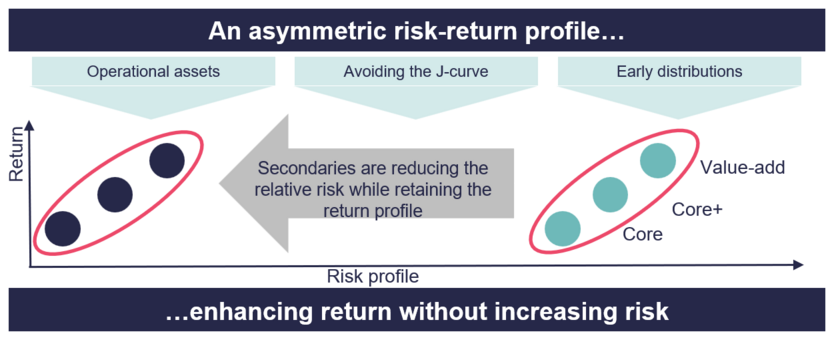

A key advantage of infrastructure secondary investments is their ability to avoid the traditional J-curve effect common in private markets. While primary funds often deploy capital gradually into early-stage or greenfield projects, incurring fees and delays before generating returns, secondaries offer immediate exposure to mature, cash-yielding assets. With known performance histories and shorter holding periods, investors benefit from faster capital deployment, lower risk, and earlier yield.

In times of market dislocation, these assets often trade at discounts to net asset value, enhancing return potential while mitigating downside risk. This combination of pricing efficiency, visibility, and speed makes infrastructure secondaries far more than a liquidity tool - they represent a strategic entry point for risk-aware investors.

Investing in secondary infrastructure assets generally offers a more favourable risk profile compared to primary investments, primarily due to increased visibility and reduced uncertainty, and the continuity of asset management. Unlike primary investments, which often involve blind pool risk and unproven strategies, secondaries provide exposure to existing, operational assets with established governance and no disruption in management. This means the value creation process is already underway and can continue uninterrupted, enabling investors to step into a stable, de-risked environment with a clear line of sight on performance and outcomes.

SFP Infrastructure Partners (SFP IP)

As one of the few dedicated players in the infrastructure secondary (mid-cap) market with a proven track record, SFP IP is ideally positioned to capitalize on the current market volatility. While many investors remain cautious amid macroeconomic uncertainty, SFP IP can leverage its specialization and experience to identify attractive entry points and selectively acquire high-quality infrastructure assets. This strong positioning as a focused secondary investor enables the firm to capture pricing advantages, manage risk effectively, and benefit from stable cash flows and faster return of capital—delivering a clear competitive edge that is allowing to solve investor’s needs.

SFP IP has launched its first fund focused on infrastructure secondaries in 2022 and held its final close in 2024 with EUR 130m. The fund has been able to deliver strong results as a direct outcome of its strategic approach with a gross performance of 19% (IRR) and1.2x (money multiple) as of Q4 2024.

SFP IP is currently working on a successor fund, launching in June 2025, to meet the growing interest of institutional investors across Europe in mid-market infrastructure secondaries.

Contact

Partner, CEO

SFP Infrastructure Partners

Investment Professional

SFP Infrastructure Partners

![[Translate to Englisch:] [Translate to Englisch:]](/assets/group/_processed_/3/f/csm_The_Future_a342b572e5.jpg)