Switzerland real estate stocks hold their own in an active capital market environment despite global volatility

Compared to the global or US equity markets (MSCI World Index -1.4%, S&P 500 -5.1% as at the end of April), Switzerland's real estate stocks were able to confirm their "safe haven" status.

Although the SWIIT index has fallen slightly since the beginning of the year, this is understandable given the high valuations at the end of the year and the high issue volume. Real estate shares appear to be defying the global turbulence and have made further strong gains since the beginning of the year. In general, the real estate capital market is highly dynamic with numerous capital increases and M&A activities.

SWIIT Index: High issue volume

After a strong performance in the year 2024, thanks in part to interest rate cuts by the SNB, some real estate funds have consolidated (SWIIT TR -0.51% as at the end of April). Global uncertainties, the already high valuations (the average Premium was around 34% at the end of 2024) and a very high issue volume are likely to be the main drivers of the flat performance.

- Capital increases: the high Premiums allow the funds a good basis for issues, which numerous products have already utilised:

- Active entitlement trading: With the exception of the Schroder ImmoPlus capital increase, there was brisk activity in entitlement trading, with more than 1/3 of the entitlements often traded. This indicates that investors were actively positioning themselves in capital market transactions.

- High issue volume: the issue volume of listed funds in the 1st quarter (and also up to the end of April) is significantly higher in 2025 than in the two previous years:

- Merger activities: The listing of the Helvetica products Helvetica Swiss Opportunity (HSO) and Helvetica Swiss Living (HSL) added to the high level of capital market activity. The former fund will merge with the Helvetica Swiss Commercial Funds (HSC) in June. The merger plans for UBS products have also been adjusted again, with the decision to merge three residential property funds (LivingPlus, Hospitality and Residentia), but not to integrate UBS Direct Residential and leave it in its current form. This will allow the three combined funds to focus on "alternative forms of housing". The merger is planned with retroactive effect as at 30 June 2025, and the terms are expected to be announced with the publication of the financial statements in mid-September. The number of securities in SWIIT is therefore expected to decrease again in the second half of the year compared to the end of 2024, despite the planned listing of Comunus SICAV.

REAL Index: continued strong performance, M&A activity and dividend increases

As at the end of the year, property shares still had some catching up to do compared to property funds in terms of valuations. The average Premium for property shares was still around 11% as at the end of 2024. REAL was able to continue its performance in the year 2025 (TR+ 15.9% as at the end of April), driven in particular by the positive share price performance of the three large caps SPS (+21.5%), PSP (+ 17.4%) and Allreal (+14.1%).

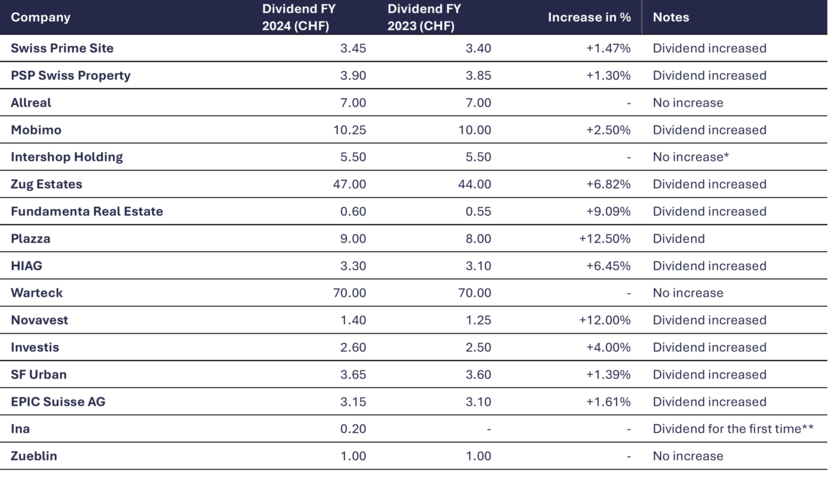

- Dividend increases: Numerous companies were able to present good annual results, with increases in operating results. As a result, dividends were increased for most property shares (11 out of 16 property companies increased their dividends):

**Before the merger with the Cham Group, Ina distributed a dividend for the first time

Source: SFP Ltd, Bloomberg

- M&A: The capital market is also showing signs of dynamism in real estate shares, illustrated by the merger of the listed Ina Invest with the non-listed Cham Group under the new name Cham Swiss Properties. Following the merger, the management hopes that Ina's development projects can be financed without a capital increase for the time being, as Cham Group has a higher equity ratio and should therefore still have the capacity to increase its debt capital.

- Accelerated bookbuilding: Swiss Prime Site used the capital market to raise CHF 300 million in an accelerated bookbuilding ("ABB") transaction excluding subscription rights. Although this type of capital raising is nothing new for shares, it has not often been used for real estate companies. The main advantage of the ABB is that it offers greater flexibility in market timing, as the transaction can be launched quickly and therefore requires less lead time than a discounted rights offering with subscription rights, which until now has tended to be the standard for real estate companies.

Non-listed market and investment foundations: high demand from investment foundations

- Oversubscriptions: Numerous investment foundations have raised capital again and in some cases registered significant oversubscriptions. This illustrates the strong demand from institutional tax-exempt investors for real estate investments, also in connection with falling interest rates and as an alternative to bonds.

- Capital increases also in commercial products: Non-listed funds also gained momentum, with further capital increases. Although residential products are favoured by some investors, the ERRES - Commercial Income and the SPSS Investment Fund Commercial were able to raise capital with full subscriptions in the commercial segment. In addition, a successful product launch took place in March with the first issue of the PRETIUM Real Estate Fund with Total fund assets of over CHF 400 million.

Market outlook and trading topics

Our Outlook for real estate investments remains positive overall. Both the fundamental drivers and the situation on the capital market, characterised by the geopolitical situation, mean that Switzerland's real estate investments will shine as concrete gold in the medium term. In our base scenario, we see moderate price potential in the short term due to the valuations and the upcoming capital increases. Price setbacks offer buying opportunities thanks to the stable fundamentals and uncertainty on the global capital markets

The capital market is likely to remain dynamic and further product harmonisations for UBS funds are still to come. The announcement of the planned merger between the two insurance groups Baloise and Helvetia could also have an impact on the respective real estate funds.

Contact

Corporate Finance Manager

![[Translate to Englisch:] [Translate to Englisch:]](/assets/group/_processed_/7/c/csm_SFP_Zins_3f9a0c4230.jpg)